Several analysts opinions contained herein, fwiw.

https://www.hollywoodreporter.com/b...sney-stock-drop-analysts-earnings-1235892297/

Why Disney Stock Dropped Sharply Despite Nearing Streaming Profit, Improved Earnings Outlook

The entertainment giant reported mixed fiscal second-quarter earnings and some near-term challenges, including at theme parks.

May 7, 2024 9:26am

by Georg Szalai

Disney‘s latest quarterly earnings report and conference call with management had much for Wall Street to like, including progress toward streaming profits and an increased full-year earnings forecast, but it wasn’t enough to keep its shares from dropping around 10 percent on Tuesday.

As of 12:15 p.m. EDT, Disney’s stock was down 10.4 percent at $104.32, making it one of the stock’s worst days over the past year.

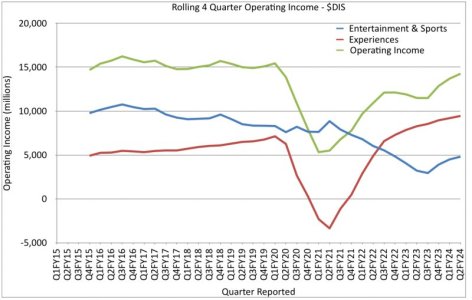

While many analysts sounded upbeat notes on several fronts, especially Disney’s moving closer to streaming profitability, the Hollywood conglomerate reported mixed fiscal second-quarter

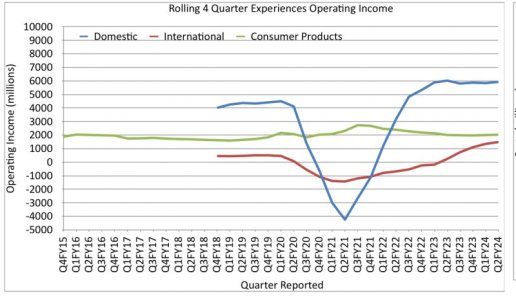

earnings and some near-term challenges, including at theme parks. Newish Disney CFO Hugh Johnston, for example, warned on the earnings call that despite “healthy demand” at parks, “we are seeing some evidence of a global moderation from peak post-COVID travel.”

All in all, it wasn’t enough to boost bullishness to new heights. And with Disney’s stock up nearly 20 percent so far in 2024 before the earnings update, well ahead of the broad-based S&P 500 stock index’s gain of around 9 percent, it seemed like it would have been too big an ask to beat investors’ expectations so convincingly as to drive the shares even higher right now.

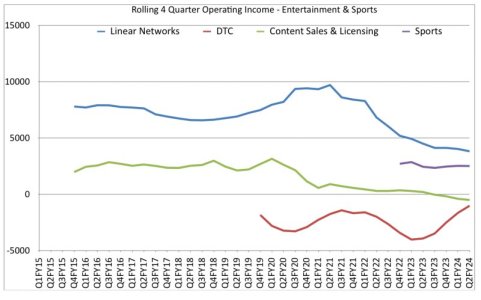

Not that there wasn’t a focus on the positive expected later this year. For example, many financial experts highlighted the fact that Disney narrowed its streaming loss to

$18 million and even reached a $47 million profit when excluding ESPN+, while reiterating that its streaming division will be in the black in the fiscal fourth quarter, as previously promised, and be a “meaningful future growth driver for the company.”

With consistent streaming profitability having long been an

elusive goal for entertainment titans, Wall Street observers, in their post-earnings commentary, touched on the success of Disney and CEO Bob Iger, who recently emerged from a bruising proxy battle, in approaching it. The latest streaming improvements also come after an extended struggle to convince analysts that Iger’s overhaul initiatives will pay off.

Here is a closer look at Wall Street experts’ key takeaways from Disney’s latest results and forecasts.

CFRA Research analyst

Kenneth Leon on Tuesday cut his rating on Disney’s stock from “buy” to “hold” and slashed his price target by $23 to

$116. “We have less confidence in Disney realizing consistent results in its entertainment and sports units,” he explained. And he highlighted that his new stock price target assumes “a forward total enterprise value/earnings before interest, taxes, depreciation and amortization of 13.4 times, below the three-year historic average at 13.6 times.”

Bank of America analyst

Jessica Reif Ehrlich reiterated her “buy” rating and

$145 price target on Disney’s stock on Tuesday. “Disney reported a solid fiscal second quarter with revenue essentially inline and operating income modestly ahead of our expectations,” she cheered. “The company also raised their fiscal year 2024 earnings per share outlook to 25 percent, versus at least 20 percent previously.”

The expert highlighted that Disney’s direct-to-consumer (DTC) did better than she had expected, while traditional TV came in weaker. “DTC outperforms while linear lower than expected,” she concluded in the headline to one of the paragraphs in her report. “Linear networks operating income was $752 million (versus our $800 million) as lower domestic revenue was driven by lower affiliate revenue due to the non-renewal of carriage of certain networks and a decline in advertising revenue attributable to a lower average viewership.”

Another gray cloud in the sky was provided by a look at the current quarter. “Disney now expects fiscal third-quarter experiences operating income to be similar to the prior year which implies operating income around $300 million below our current forecast,” she noted.

Reif Ehrlich’s overall bullish takeaway: “Disney has a collection of best-in-class premier assets (in content/IP as well as theme parks). Near-term catalysts include: 1) additional updates on strategic priorities for Disney, 2) an inflection in profitability in DTC.”

UBS analyst

John Hodulik also pointed out mixed trends, but in the headline of his report highlighted: “Earnings per share & free cash flow pacing ahead.” He stuck to his “buy” rating and

$140 price target on Disney shares.

“DTC was profitable,” excluding ESPN, he wrote. “Management expects softer DTC profits in the fiscal third quarter (UBS estimate: -$52 million) due to Hotstar but profitability in the fiscal fourth quarter. Core Disney+ subscribers increased by 6.3 million (UBS estimate 5.9 million; guide 5.5-6.0 million), including 7.9 million in the U.S. and Canada adds with the Charter deal (UBS estimate 7.5 million). Hulu subs increased by 0.5 million (UBS estimate: flat) versus 1.2 million in the fiscal first quarter.”

Hodulik also emphasized Disney’s increased full-year earnings outlook but pointed out “mixed” theme parks commentary that didn’t surprise him too much. “Disney reported stronger earnings per share and in-line revenues, while forward commentary for the parks was mixed due to higher costs from the new cruise ship (similar to previous launches).”

Wolfe Research analyst

Peter Supino maintained his “peer perform” rating without a stock price target in his first take. He highlighted “better results at DTC and sports, and in-line experiences, partially offset by softer linear networks and content/licensing

performance.”

The expert explained that linear results were “impacted by the non-renewal of carriage of certain networks by Charter,” while the content/licensing business posted a quarterly loss as “revenue came in weaker at $1.39 billion (consensus: $1.51 billion) as there were no significant titles in the current quarter.”

Beyond Wall Street,

Third Bridge analyst

Jamie Lumley also dissected the good and the challenging in Disney’s quarterly results and outlook. “Disney continues to push for streaming profitability and is making substantial progress towards its goal,” he wrote. “A loss of $18 million is a huge improvement for the direct-to-consumer segment that at times has lost over $1 billion a quarter.” He added: “The U.S. streaming market in particular is mature and difficult to navigate, making Disney’s near-8 million Disney+ subscriber adds a very positive sign.”

But it’s not all roses. “Disney’s business is facing a few challenges. $2 billion in goodwill impairments driven by Disney’s operations in India and linear business are weighing on results, in addition to the ongoing cord-cutting pressure that will continue to impact Disney’s networks,” warned Lumley.

And then there is that old question of who will succeed Iger. “Investors are still looking for clarity on succession planning. We’ve heard from our experts that Dana Walden is the frontrunner for the CEO role, but at this point nothing is set in stone,” highlighted Lumley. “We might not hear any updates until 2025 as Disney’s board makes sure it finds the right candidate for the job.”